Yes, home and in fact most property policies of all types are seeing an increase in insurance costs. These last two years property claims have cost insurance companies much more than they had accounted for.

While Michigan is not seeing increases of 40% to 70% like a number of states, we are seeing carriers across the board increase the cost of property insurance in 2023.

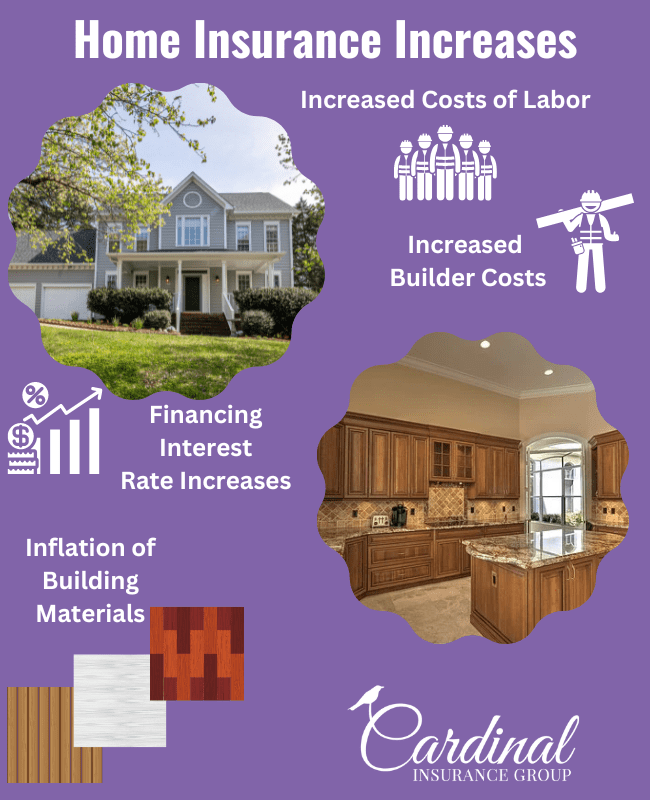

Recent high inflation is no secret, and the home construction business has seen some of the largest increases. When rebuilding homes damaged by fire or storms, carriers are having to pay soaring building costs resulting from higher-than-average labor costs, and the scarcity of materials.

These higher costs mean that the majority of homes are underinsured considering the inflation percentages that are present today. To combat that, you will most likely see a higher increase in your dwelling limit on your next insurance renewal.

Here are a few recommendations to help with your insurance costs. Protect and try to increase your credit score as a high score usually results in a high insurance score discount. Consider higher deductibles of $1,000 or even $2,500. Bundle your home, and auto and umbrella liability policies with the same company, and take advantage of affinity discounts if you are a member of a senior organization, professional association, or a veteran. All of these will help in keeping your insurance costs within an affordable budget. If your company doesn’t offer these discounts, give us a call. Most of our carriers provide substantial group and affinity discounts.