This is one of the most frequent questions we are asked, and the answer is, it depends.

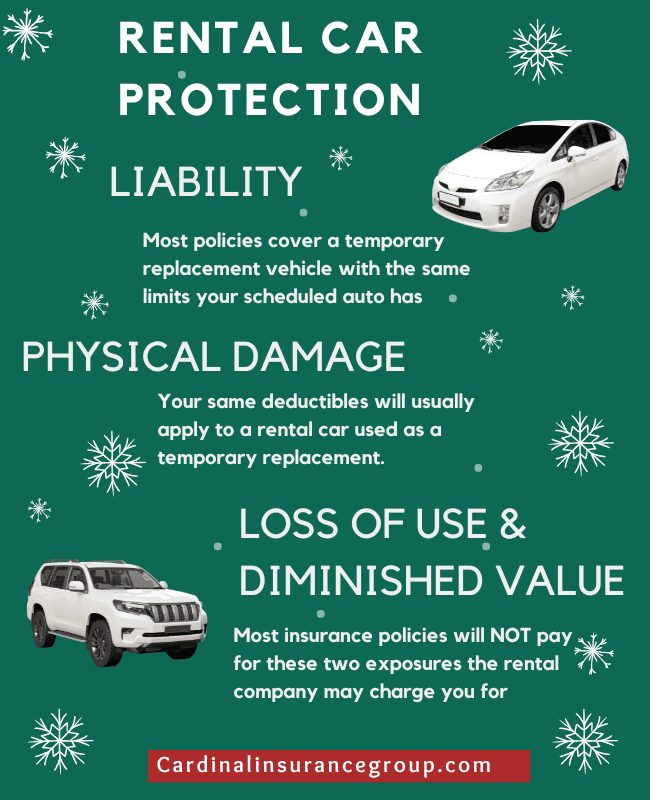

Michigan auto policies provide coverage for a ‘temporary replacement vehicle’, and that coverage mimics your own. That means if you have liability but no physical damage on your vehicle, liability is the only coverage you will have on a rental car.

Your policy responds as though you were driving your own vehicle, so policy deductibles are applied when a loss occurs. Also, claims against a rental vehicle can result in surcharges or loss of credit on your current insurance policy if your insurance is used to repair the rental.

There are two expenses the rental company may hold you responsible for that your auto policy most likely will not cover: loss of rental income and diminished value.

Loss of rents is when the vehicle you damaged is in a body shop getting repaired and they are losing money to rent it.

Diminished value is a surcharge the manufacturer charges to rental car companies (which they pass on to you) because vehicles with losses on their car history report are worth less.

Certain credit cards also have some rental car benefits if you use their card when renting a vehicle. The coverages and availability vary so you would need to check with your credit card company for details.

Regardless of how you choose to pay for rental car insurance protection, we recommend that you read the agreements that you are signing so you are aware of your liability in case of an accident or loss.