The quick answer is yes landscapers need business insurance. Here we will look at the different exposures and insurance products specifically for landscaping businesses.

General liability insurance protects the business when held liable for property damage or injuries. This can be a simple case of a lawn mower throwing a rock through a window, or as serious as that rock hitting a child that was playing in the neighbor’s yard.

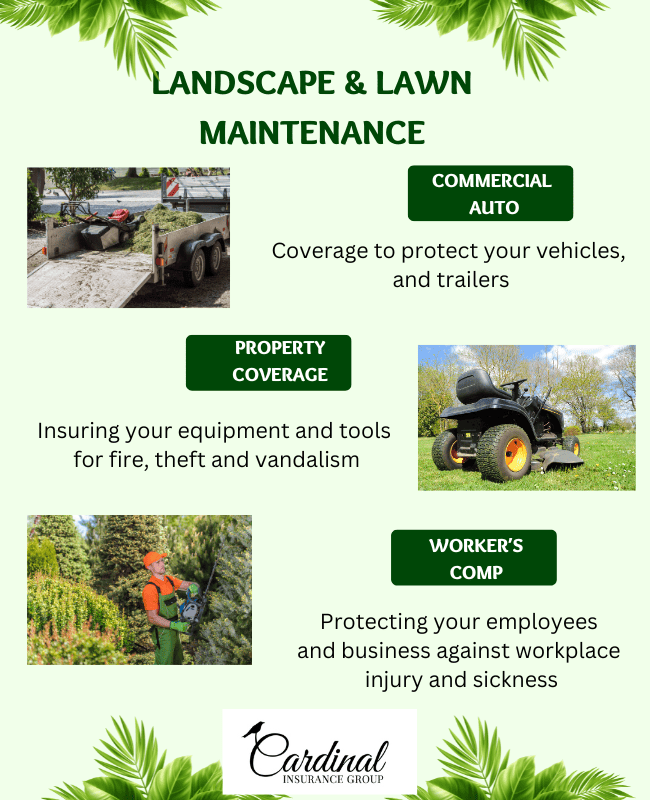

A general liability policy can also include property coverage for equipment used in the business such as lawn tractors, weed trimmers etc.

If you hire employees, you may also be required by law to purchase workers compensation. This protects the employee who is injured or becomes sick during the course of their work.

You will also need to discuss your business with your auto insurance agent. Many landscapers drive their personal truck and don’t think to contact their auto insurance agent to advise.

A personal auto policy does not protect your business or yourself for vehicles used in a business. A high speed accident with a trailer full of equipment can do much more harm to others on the road than just a truck that drives to and from work daily. For that reason, vehicles used in business need to be insured on a commercial auto policy.

Our agency protects landscapers throughout the state of Michigan, so don’t hesitate to reach out if we can assist.