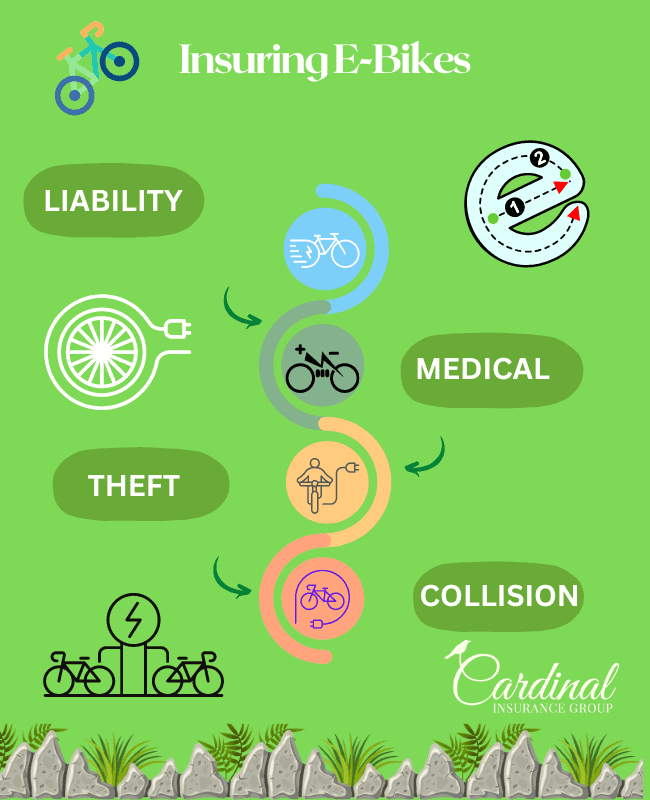

If your E Bike is stolen or someone is injured on it and sues you, are you properly insured?

As the E-Bike trend seems to be here to stay, a number of insurance carriers (but not all), are amending policies or creating them to cover the unique exposures these self-propelled bikes bring.

There is no standard way that insurance companies are choosing to insure E-bikes. Some won’t cover them at all, and some will limit what they cover and for how much.

You should be consulting with your agent to see about both liability and physical damage protection for your e-bike. We would recommend before contacting your agent that you know the class of your e-bike; 1,2 or 3, as that may affect which companies are willing to provide coverage.

A limited number of insurance companies in Michigan will allow you to add all 3 classes to your home, renters or condo insurance. And yet others will only provide coverage for class 1 and 2 E-bikes. And a small handful of carriers will require that you purchase a stand-alone policy called a personal articles policy, and then there are still some that won’t insure them at all.

You should always contact your agent when you are not sure of your coverage, as all property policies (home/renters/condo) have built-in exclusions for a number of items such as land or amphibious vehicles that are self-propelled or capable of being self-propelled, as well and the common watercraft and recreational vehicle liability exclusions once the items are taken off your residence premises.